Compliance Assistance

Stay Legal. Stay Protected. Focus on Your Business.

You didn't start your business to become an employment law expert. You started it because you're passionate about your food, your service, your craft. But keeping up with ever-changing regulations at the local, state, and federal level? Nearly impossible when you're already working 60-hour weeks.

And you shouldn't have to.

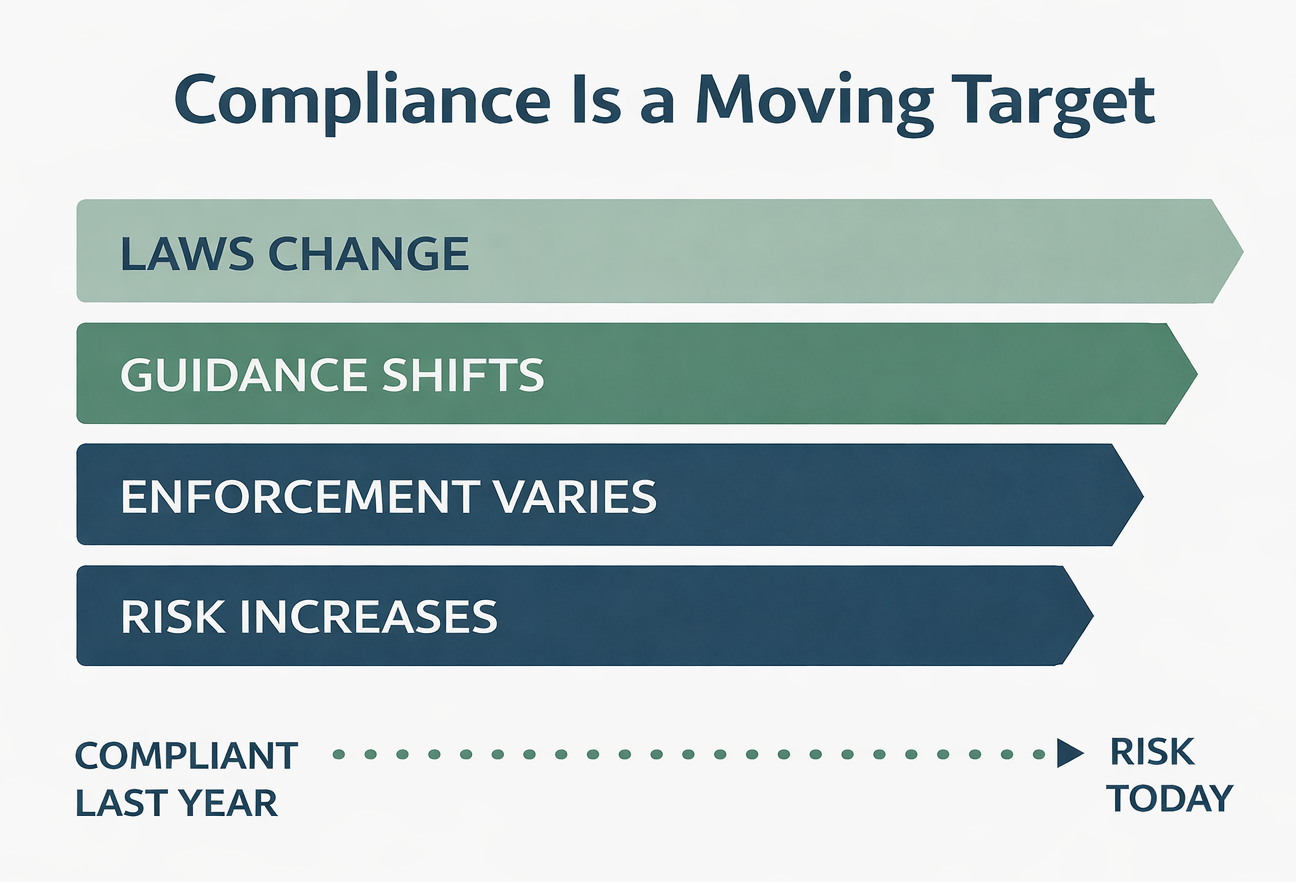

Employment laws constantly evolve. New Maine regulations roll out. Federal guidance changes. Court decisions shift interpretations. What was compliant last year might not be today.

One mistake can trigger fines, lawsuits, back wages, and reputational damage.

With over 30 years of Maine HR experience, I help small businesses identify compliance gaps, prioritize fixes, and create systems to stay compliant - so you can focus on running your business.

Common Compliance Risks

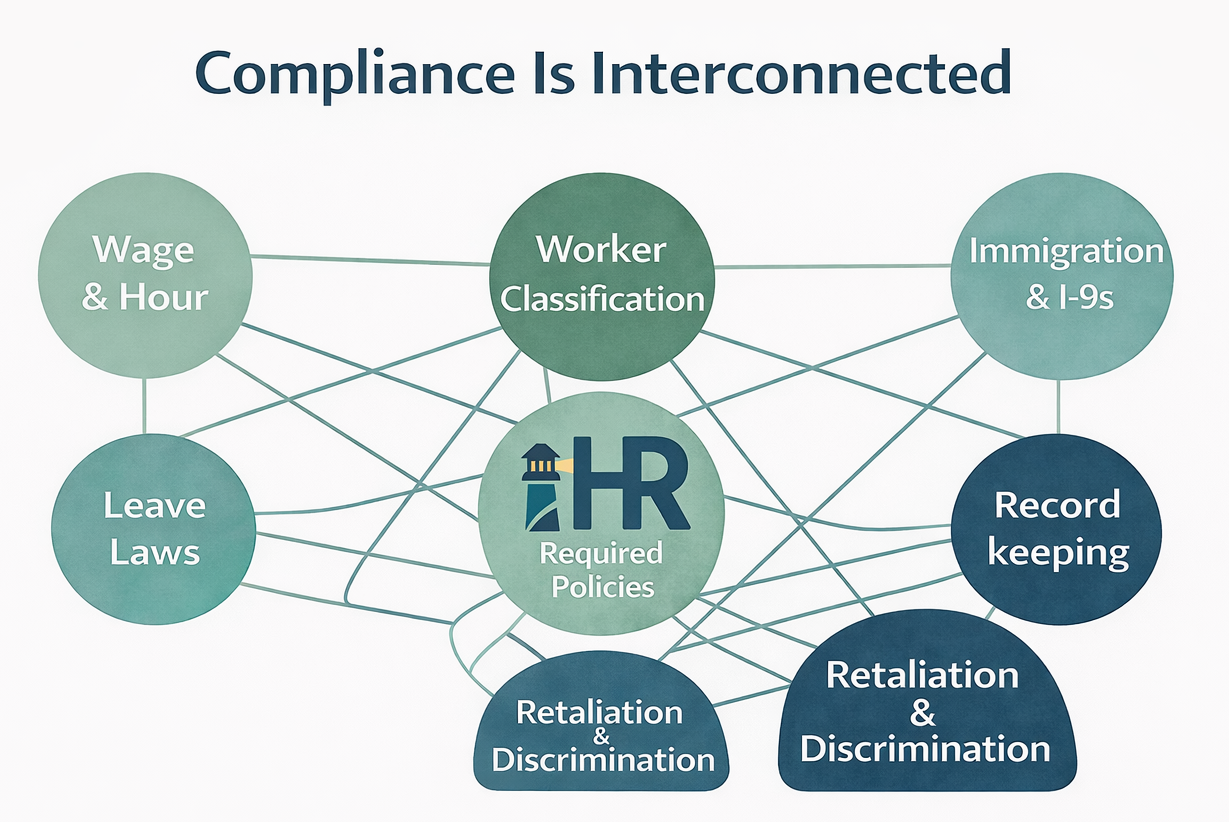

Employment compliance issues rarely come from intentional wrongdoing. Most problems stem from outdated practices, unclear guidance, or systems that haven’t kept up with changing laws. The most common risk areas I see for Maine employers include:

Wage & Hour Compliance: Overtime calculations, meal and rest breaks, tip credits, service charges, final paychecks, and off-the-clock work are all heavily regulated in Maine. Small errors can compound quickly into back wages, penalties, and audits, particularly in hospitality and service industries.

Worker Classification: Misclassification of employees as exempt, non-exempt, or independent contractors is one of the costliest compliance mistakes employers make. Errors here can trigger years of back wages, tax liability, and penalties under both state and federal law.

Immigration & Employment Eligibility (I-9 Compliance): Incomplete, late, or improperly handled I-9 forms are among the most frequently cited federal violations. These issues are often paperwork-related rather than intent-based, but penalties are assessed per form and can add up quickly without proper systems in place.

Leave Law Compliance: Maine employers must navigate overlapping leave laws, including Earned Paid Leave, federal and state FMLA, Maine Paid Family and Medical Leave (effective 2026), and ADA accommodation requirements. Inconsistent tracking or documentation is a common source of violations.

Required Policies, Notices & Training: Maine law requires specific written policies, workplace postings, employee notices, and training documentation, including sexual harassment prevention. Missing or outdated materials weaken your compliance position, even when day-to-day practices are appropriate.

Recordkeeping & Documentation: Accurate records of hours worked, wages paid, personnel actions, discipline, and leave usage are essential. Without proper documentation, employers are significantly disadvantaged during audits, investigations, or litigation.

Retaliation & Discrimination Risk: Many claims arise not from the original issue, but from how it is handled. Inconsistent enforcement, poor documentation, or informal management practices can expose employers to retaliation or discrimination claims, even when the underlying concern was valid.

How I Help

Compliance failures rarely come from a single mistake. They happen when systems break down, documentation is inconsistent, or practices haven’t kept up with changing laws. My approach focuses on identifying risk, fixing gaps, and putting durable systems in place.

Compliance Audits: A structured review of your current practices, documentation, and policies, with a written report identifying risk areas and clear, prioritized action steps.

Policy & Documentation Development: Maine-compliant policies, notices, and documentation practices that align with how your business actually operates, not generic templates.

Worker Classification Reviews: Analysis of exempt vs. non-exempt roles and employee vs. contractor relationships to ensure classifications are legally defensible under Maine and federal law.

Immigration & I-9 Audits: Review of I-9 completion, retention, and verification practices to identify and correct errors before a government audit or investigation.

Recordkeeping & Systems Design: Implementation of compliant systems for personnel files, payroll, time tracking, leave management, and disciplinary documentation.

Training & Manager Guidance: Practical training for managers and staff on Maine employment law, harassment prevention (required for employers with 15 or more employees), documentation standards, and day-to-day compliance responsibilities.

Ongoing Monitoring & Updates: Periodic reviews and updates as laws, guidance, and enforcement priorities change, so compliance doesn’t erode over time.

Why Maine Expertise Matters

Maine employment laws are often broadly written, and how they are interpreted and enforced can vary over time and by circumstance. Guidance changes, enforcement priorities shift, and practical application does not always mirror what appears on paper.

With over 30 years of experience working with Maine employers, I understand not only what the law says, but how it is typically applied during audits, investigations, and disputes. That practical knowledge helps businesses focus on the areas that matter most and avoid compliance decisions based on assumptions or outdated guidance.

Current Maine Compliance Priorities

I-9 & Immigration Compliance

Employment of minors (hours, job duties, work permits, and scheduling restrictions)

Maine Paid Family and Medical Leave (effective 2026)

Earned Paid Leave tracking and documentation

Sexual harassment training and annual notice requirements

Restaurant tip credit and service charge compliance

Meal and rest break requirements

Whistleblower and retaliation protections

The Cost of Getting It Wrong

Compliance failures rarely involve a single fine or one bad decision. They tend to cascade, triggering financial exposure, operational disruption, and long-term damage to your business.

Financial Exposure

Wage and hour violations: Back wages, liquidated damages, and penalties, often covering multiple years of payroll

Worker misclassification: Significant per-employee penalties, back wages, payroll taxes, and interest

I-9 and employment eligibility violations: Civil penalties assessed per form, with increased fines for repeat or unresolved issues

Discrimination and retaliation claims: Costly settlements or judgments, often well into six figures, even when claims are disputed

Legal and professional fees: Attorney and expert costs that routinely run hundreds of dollars per hour over extended periods

Beyond the Fines

Reputational damage: Employment disputes become public record and can quickly surface in online searches and reviews

Negative publicity: Local enforcement actions, complaints, or lawsuits can draw unwanted attention in your community

Employee turnover: Compliance failures erode trust, increasing departures among experienced and high-performing staff

Recruiting challenges: Word travels fast in tight-knit industries and labor markets, making it harder to attract strong candidates

Management distraction: Months of leadership time diverted to audits, investigations, legal strategy, and damage control instead of running the business

Why Prevention Matters

Preventive compliance work costs a fraction of responding after a complaint, audit, or lawsuit is already underway. Strong systems, clear documentation, and proactive monitoring reduce both risk and disruption before problems escalate.